-Knowledge Base-

Outsource or Inhouse?

By Impact Analytical

Introduction

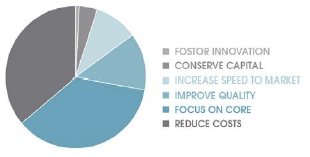

In many industries, analytical services have become a “make-versus-buy” decision. Pressures within the current economic environment are prompting some companies to develop a new perspective on which specific analytical capabilities remain “core competencies” and which can be successfully outsourced to reduce overall operating expenses. A recent industry study showed the trend in outsourcing was controlled by the following factors:

Outsourcing Models

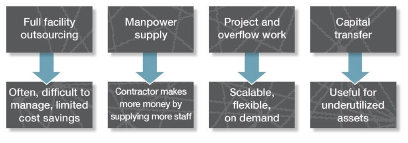

Not all outsourcing models are the same. Figure 1 gives examples of the types of models currently employed by many companies requiring outsourced analytical services and the pros/cons of each:

Advantages

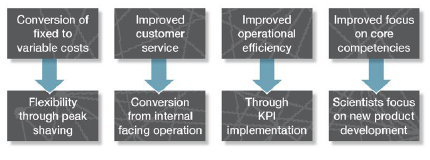

There are several advantages of outsourcing analytical services in today’s business climate. Most apparent is tapping into a high level of resident expertise from the outsourcing supplier, without having to establish and fund that expertise internally; this “pay as you go” model has become an industry favorite, having access to the resources without having to pay for it when not needed. Outsourcing also permits a greater degree of freedom in early stage projects by allowing analytical costs to be expensed, versus the likely need to purchase capital equipment to perform analysis in-house. Evidence shows that a correctly managed outsourcing project can yield savings of 20% against in house services

(see Figure 2):

In addition, an external supplier of analytical services can help mitigate risk by avoiding a large investment in analytical equipment and manpower when development efforts are in early stages. Further, outsourcing ensures a higher level of resource flexibility in developmental projects, which can be particularly important before final synthesis or manufacturing methods have been determined.

A good contract lab can help optimize resources in times of shrinking budgets and broader priorities, helping to avoid even a temporary excess of in-house analytical capability. Even in companies with “good” utilization of internal resources, the analytical departments (other than QA/QC) typically operate on just one shift, while production often continues on a second or third shift to maximize the return from equipment investment and overhead. Some firms may find it difficult to justify the total cost of owning sophisticated analytical capacity, considering the capital investment and specialized personnel required to operate equipment that’s only in use 1/3 of the available time.

Outsourcing can often be demonstrated as the lower cost approach, particularly for analyses that have low usage, demand a high degree of specialization or require expensive equipment. Contract analysis helps a manufacturer avoid the cost of continually upgrading equipment and training personnel in the latest analytical techniques. By pre-negotiating rates or contracting for a set amount of testing, manufacturers can have a clear indication of the development costs for analytical services, while taking advantage of the most current laboratory technology. Some manufacturers find themselves with decreasing internal needs due to a change in business priorities or focus. One of the ways to ensure that cost-effective, reliable testing continues in spite of decreased project loads is to outsource the function. The overhead of analysis is then born by the contract laboratory, not the requesting company.

Conversely, during a business upswing, as development efforts and products pass through the explosive growth part of their lifecycle, the need for analysis, testing and quality control often increases faster than the company’s ability to acquire additional resources. Using contract services can help avoid a potential bottleneck which slows development, thus decreasing a product’s time-to-market.

While capital savings can be substantial, an often-overlooked expense is manpower. Up to 70% of the cost of a laboratory can come from the labor burden and as such maximizing every dollar in that area is critical. High level PhD. staff are better utilized on new product development; whereas the contract lab partner can handle the more routine functions such as Extractable & Leachable or impurity studies.

Hurdles

The obstacles to contracting analytical services are similar to those in any outsourcing situation. The first is always the need to sift through a large number of potential suppliers to find those few which have the specific capabilities needed. With an estimated 50,000 organizations providing contract analytical services in the U.S., it can be a daunting task to identify the firm which does a quality job, at a reasonable cost, in a timely manner. This list can be reduced drastically when simple measures such as accreditations and certifications are considered (see next chapter). Simplicity is another issue; when using in-house resources, the process may be as effortless as dropping off samples at an internal location. No matter how good the communication between lab and customer, the outsourcing process will be more complex.

Internal pressures are also likely to surface. There is often resistance from internal analytical personnel, who view outsourcing as a direct threat to their jobs and livelihood. By their nature, analytical scientists will invariably prefer to add new laboratory capabilities rather than contract on the outside. There can also be a perceived loss of control, from which the product development scientists may fear they will be out of touch with the key analytical people and techniques needed for their project’s success. As respected experts, internal analytical scientists can sway company opinion about whether to outsource. The loss of control is a perception that needs to be explained to senior management; however, the controls measures remain, although somewhat different. When accurate KPI’s are put in place the control is not lost, it becomes heightened with fewer processes to monitor. In addition, an outsource laboratory with knowledgeable staff that is willing to work in a collaborative relationship, can alleviate concerns.

Some manufacturers may fear that turnaround time will suffer when samples must be shipped long-distance instead of taking them to the building next door, but a physical separation between customer and laboratory should not significantly increase turnaround time. In fact, because a successful contract lab is staffed to be very responsive to customer needs, external turnaround can actually be faster. Materials can be shipped anywhere in the U.S. to arrive in less than 24 hours, using established commercial carriers. International borders can cause delays, however, and shippers need to determine the carriers and tactics which best serve to expedite progress. Test results and data can be returned electronically, via client portals, e-mail or teleconference.

Meeting Standards

A key issue for manufacturers is the contract lab’s ability to conform to established standards. Outsourced testing for any organization submitting products to the FDA for review and approval must be completed in accordance with GLP (Good Laboratory Practice) standards, which ultimately, helps reduce development costs and time to market. Depending on the product, labs may also be required to be cGMP (current Good Manufacturing Practice) compliant, indicating that they are in conformance with CFR 21 (Code of Federal Regulations), Section 211. The backbone of GLPs and cGMPs is documentation of protocols, reports, data collection techniques, personnel qualifications and archival procedures. The process requires complete traceability from sample submission, including all project steps at the analytical lab, through the time the data are ultimately archived.

GLP/cGMP compliance extends the customer confidence earned by a laboratory’s accreditation under recognized quality management standards, such as ISO 9001:2015. With these standards in place, manufacturers and distributors of drugs and medical devices can be assured that test data from a certified lab are both valid and supportable. Having GLP/cGMP compliance also means that a lab can provide data for discovery stage chemistry before documentation is prepared for the FDA.

Obviously, testing that meets ASTM, ISO, GLP/cGMP and/or other standards is an indication of a lab’s competence. Registration by an external auditing firm means that an outside agent has reviewed the lab’s processes in general and found that it is operating within the listed guidelines. If any concerns arise, ask about auditing the quality program to make sure all details of the lab’s quality plan are clear.

Selecting A Lab

The first consideration in choosing a laboratory partner is deciding which of the manufacturer’s analytical needs are the most likely to benefit from outsourcing. For example, it could be argued that for some pharmaceutical firms, quick-turnaround analysis used to monitor production in real time cannot be efficiently outsourced. Whereas more “routine” testing such as batch analyses and lot release testing, and long-term projects, such as stability testing, would be good candidates for outsourcing.

References from trusted industry contacts are probably the best way to find a good analytical lab, when discussing potential projects with the candidate lab, ask if any work will be subcontracted. Even if the parent lab is highly reliable, the workmanship may not translate to the subcontractor.

Most labs focus on a particular area of expertise, so make sure the analytical partner is strong in specific areas of need, with qualified scientists, experienced managers, current equipment and a track record of success. Verify also that the company’s experience and technical capabilities in Product Development, Manufacturing and R&D match current and long-term needs. Look for reasonable experience using those capabilities on projects similar to yours; ask for case studies or other published success stories and look for a history in related applications.

It may also be helpful to briefly examine a laboratory’s business history, which can often be found online. How long has it been in operation? Is it financially healthy and capable of a long-term business relationship? As with any business, good signs include repeat customers, steady growth and a sound financial base, all indicators of long-term survival.

Avoid the need to manage several contractors by determining whether a facility has the staff and equipment to handle a variety of analytical needs. Does it offer broad analytical capability, or is it limited to one primary area of expertise? A broadly skilled laboratory allows a wide range of different projects to be undertaken in one location, which helps simplify communication and data transfer. Look into potential capacity limitations, also: Will the lab be able to consistently meet important deadlines? Is the equipment up-to-date and well-maintained, with regular and documented calibration? Does the firm have contingency plans in case of absent employees or instrumentation problems?

As with any outsourced function, if no single vendor can provide the breadth of capabilities to meet all of a company’s analytical needs, look for a few labs that are good at what they do, rather than having several vendors for any given test regimen. It’s more expensive to manage multiple vendors, so finding a lab with a broader scope can help decrease total costs.

Once vendor selection has taken place, get to know the lab personnel and the qualifications of the analysts, particularly those who will actually be analyzing samples or developing test methods. Confirm that all QC checks are in place, and that customers have access to the scientists actually working on a project, not just a sales representative. Identify an application or two that will allow the candidate lab to demonstrate its expertise and service, before committing large resources to a new vendor.

Real Costs

There is often a belief that outsourcing analytical activity will cost more than performing the same activity internally, despite the number of indirect expenses associated with maintaining that capability in-house. The opposite is in fact true, studies show outsourcing of laboratory functions, when controlled through accurate KPI’s can lead to a reduction of cost of up to 20% Evaluating the true costs of research and testing requires a manufacturer to factor in the expense of facilities and upkeep, equipment and maintenance, utilities, supplies, salaries and benefits, accounting and management. When comparing those expenses with an outsourcing option, the primary issues are the actual cost of the contract services, along with shipping and coordination of activities.

Regardless of the quality standards which apply to a given project, good written documentation is important to minimize potential confusion, especially at the beginning of a new relationship, and the specific individuals requesting and performing the analysis should communicate directly. On each project, be sure to indicate any specific research, development and/or testing requirements, as well as timing. There’s no substitute for one-on-one discussion before testing begins, particularly when complex analysis is involved. Look for a lab that values this level of communication. One of the biggest causes of failure in an outsourcing project is lack of communication. Evidence shows that when both sides present a project manager to deal with the communications, the service levels improve, and issues are dealt with prior to them becoming project roadblocks. While this is an investment in time on both sides the benefits clearly outweigh the costs.

An experienced and professional laboratory should be able to provide a boilerplate agreement for just about any project. If customers prefer that their own legal department drive the process, a standard agreement for research services and testing will streamline the process when arranging specific project details. Make certain that terms are clearly outlined concerning safety, confidentiality, intellectual property, additional analysis, conflict of interest and disposal of chemicals.

Fees and turnaround times vary widely between labs, but most charge between $125-$300/hour and offer 1-30-day lead times, depending on the complexity of the analysis. As with any buying decision, specify exactly what’s to be delivered for the purchase price. Some analytical labs provide only test data, while others have the experience and personnel to offer interpretation, method development, material identification, reverse engineering and other services. If all that’s needed is repeat “commodity” testing which hasn’t changed in years, there’s no need to pay for additional costly services. On the other h and, if outside technical assistance or interpretation may be required, the contractor must be able and prepared to deliver it.

Finding a contract analytical lab that can meet a manufacturer’s present and future needs

(within reasonable cost constraints) should not be a business nightmare. There’s bound to be some period of transition as the contractor’s personnel get up to speed on specific needs and internal staff members learn how to best take advantage of the lab’s strengths. But once the process is established, the make-vs-buy decision should ultimately help improve the bottom line.